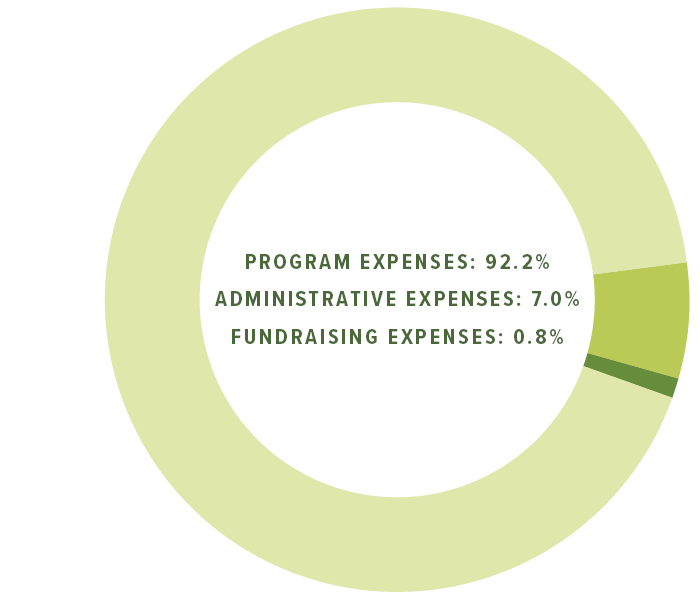

As with other nonprofit organizations, AWI’s expenses are broken down into three categories: administrative expenses, fundraising expenses, and program expenses. The first two are generally thought of as operating expenses (or “overhead”), while the latter—program expenses—are those directly related to fulfillment of the organization’s mission. As indicated by the diagram, the vast majority of AWI’s expenses are program related—spent directly on efforts to reduce animal suffering caused by people.

View an independent auditors' report of AWI's 2023–2024 Financial Statements and view our latest Form 990 filed November 15, 2024 for the fiscal year ending June 30, 2024. You can also access our 990s at the Guidestar website. AWI's Federal Employer Identification Number (FEIN or Tax ID) is 13-5655952.

To read about our activities over the past fiscal year to improve animal welfare, check out our annual report.

Ratings by Independent Philanthropic Organizations

AWI has been evaluated by Charity Navigator and has received the highest ratings. This independent evaluation is intended to assure the public that AWI is properly governed, that our programs are consistent with our statement of purpose, that our funding is sound, and the bulk of our annual expenses is devoted to our programs to protect animals. For further information on AWI, you may contact the aforenamed organization:

Charity Navigator 1200 MacArthur Boulevard Second Floor Mahwah, New Jersey 07430 (201) 818-1288 charitynavigator.org |

In addition, AWI qualifies for the Combined Federal Campaign (CFC), a workplace charity program of the federal government’s Office of Personnel Management. The CFC enables federal employees to support approved charities of their choice through annual payroll deductions. AWI’s CFC number is 10474, and we are a member of the Animal Charities of America federation. Learn more about ways to give to AWI.